Why Bitcoin is Not a Ponzi Scheme: Point by Point

Find more of Lyn’s work at lynalden.com

One of the concerns I’ve seen aimed at Bitcoin is the claim that it’s a Ponzi scheme. The argument suggests that because the Bitcoin network is continually reliant on new people buying in, that eventually it will collapse in price as new buyers are exhausted.

So, this article takes a serious look at the concern by comparing and contrasting Bitcoin to systems that have Ponzi-like characteristics, to see if the claim holds up.

The short version is that Bitcoin does not meet the definition of a Ponzi scheme in either narrow or broad scope, but let’s dive in to see why that’s the case.

Monthly Newsletter

Join 35,000+ people learning about Bitcoin

No spam. Unsubscribe any time.

Defining a Ponzi Scheme

To start with tackling the topic of Bitcoin as a Ponzi scheme, we need a definition.

Here is how the US Securities and Exchange Commission defines one:

“A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organizers often promise to invest your money and generate high returns with little or no risk. But in many Ponzi schemes, the fraudsters do not invest the money. Instead, they use it to pay those who invested earlier and may keep some for themselves.

With little or no legitimate earnings, Ponzi schemes require a constant flow of new money to survive. When it becomes hard to recruit new investors, or when large numbers of existing investors cash out, these schemes tend to collapse.

Ponzi schemes are named after Charles Ponzi, who duped investors in the 1920s with a postage stamp speculation scheme.”

They further go on to list red flags to look out for:

“Many Ponzi schemes share common characteristics. Look for these warning signs:

High returns with little or no risk. Every investment carries some degree of risk, and investments yielding higher returns typically involve more risk. Be highly suspicious of any “guaranteed” investment opportunity.

Overly consistent returns. Investments tend to go up and down over time. Be skeptical about an investment that regularly generates positive returns regardless of overall market conditions.

Unregistered investments. Ponzi schemes typically involve investments that are not registered with the SEC or with state regulators. Registration is important because it provides investors with access to information about the company’s management, products, services, and finances.

Unlicensed sellers. Federal and state securities laws require investment professionals and firms to be licensed or registered. Most Ponzi schemes involve unlicensed individuals or unregistered firms.

Secretive, complex strategies. Avoid investments if you don’t understand them or can’t get complete information about them.

Issues with paperwork. Account statement errors may be a sign that funds are not being invested as promised.

Difficulty receiving payments. Be suspicious if you don’t receive a payment or have difficulty cashing out. Ponzi scheme promoters sometimes try to prevent participants from cashing out by offering even higher returns for staying put.”

I think that’s a great set of information to work with. We can see how many of those attributes, if any, Bitcoin has.

Bitcoin’s Launch Process

Before we get into comparing Bitcoin point-by-point to the above list, we can start with a recap of how Bitcoin was launched.

In August 2008, someone identifying himself as Satoshi Nakamoto created Bitcoin.org.

Two months later in October 2008, Satoshi released the Bitcoin white paper. This document explained how the technology would work, including the solution to the double-spending problem. As you can see from the link, it was written in the format and style of an academic research paper, since it was presenting a major technical breakthrough that provided a solution for well-known computer science challenges related to digital scarcity. It contained no promises of enrichment or returns.

Then, three months later in January 2009, Satoshi published the initial Bitcoin software. In the custom genesis block of the blockchain, which contains no spendable Bitcoin, he provided a time-stamped article headline about bank bailouts from The Times of London, likely to prove that there was no pre-mining and to set the tone for the project. From there, it took him six days to finish things and mine block 1, which contained the first 50 spendable bitcoins, and he released the Bitcoin source code that day on January 9th. By January 10th, Hal Finney publicly tweeted that he was running the Bitcoin software as well, and right from the beginning, Satoshi was testing the system by sending bitcoins to Hal.

Interestingly, since Satoshi showed how to do it with the white paper more than two months before launching the open source Bitcoin software himself, technically someone could have used the newfound knowledge to launch a version before him. It would have been unlikely, due to Satoshi’s big head start in figuring all of this out and understanding it at a deep level, but it was technically possible. He gave away the key technological breakthrough before he launched the first version of the project. Between the publication of the white paper and the launch of the software, he answered questions and explained his choices for his white paper to several other cryptographers on an email list in response to their critiques, almost like an academic thesis defense, and several of them could have been technical enough to “steal” the project from him, if they were less skeptical.

After launch, a set of equipment that is widely believed to belong to Satoshi remained a large Bitcoin miner throughout the first year. Mining is necessary to keep verifying transactions for the network, and bitcoins had no quoted dollar price at that time. He gradually reduced his mining over time, as mining became more distributed across the network. There are nearly 1 million bitcoins that are believed to belong to Satoshi that he mined through Bitcoin’s early period and that he has never moved from their initial address. He could have cashed out at any point with billions of dollars in profit, but so far has not, over a decade into the project’s life. It’s not known if he is still alive, but other than some early coins for test transactions, the bulk of his coins haven’t moved.

Not long after, he transferred ownership of his website domains to others, and ever since, Bitcoin has been self-sustaining among a revolving development community with no input from Satoshi.

Bitcoin is open source, and is distributed around the world. The blockchain is public, transparent, verifiable, auditable, and analyzable. Firms can do analytics of the entire blockchain and see which bitcoins are moving or remaining in place in various addresses. An open source full node can be run on a basic home computer, and can audit Bitcoin’s entire money supply and other metrics.

With that in mind, we can then compare Bitcoin to the red flags of being a Ponzi scheme.

Investment Returns: Not Promised

Satoshi never promised any investment returns, let alone high investment returns or consistent investment returns. In fact, Bitcoin was known for the first decade of its existence as being an extremely high-volatility speculation. For the first year and a half, Bitcoin had no quotable price, and after that it had a very volatile price.

The online writings from Satoshi still exist, and he barely ever talked about financial gain. He mostly wrote about technical aspects, about freedom, about the problems of the modern banking system, and so forth. Satoshi wrote mostly like a programmer, occasionally like an economist, and never like a salesman.

We have to search pretty deeply to find instances where he discussed Bitcoin potentially becoming valuable. When he did talk about the potential value or price of a bitcoin, he spoke very matter-of-factly in regards to how to categorize it, whether it would be inflationary or deflationary, and admitted a ton of variance for how the project could turn out. Digging around for Satoshi’s quotes on the price of value of a bitcoin, here’s what I found:

“The fact that new coins are produced means the money supply increases by a planned amount, but this does not necessarily result in inflation. If the supply of money increases at the same rate that the number of people using it increases, prices remain stable. If it does not increase as fast as demand, there will be deflation and early holders of money will see its value increase.”

___

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy. Once it gets bootstrapped, there are so many applications if you could effortlessly pay a few cents to a website as easily as dropping coins in a vending machine.”

___

“In this sense, it’s more typical of a precious metal. Instead of the supply changing to keep the value the same, the supply is predetermined and the value changes. As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.”

___

“Maybe it could get an initial value circularly as you’ve suggested, by people foreseeing its potential usefulness for exchange. (I would definitely want some) Maybe collectors, any random reason could spark it. I think the traditional qualifications for money were written with the assumption that there are so many competing objects in the world that are scarce, an object with the automatic bootstrap of intrinsic value will surely win out over those without intrinsic value. But if there were nothing in the world with intrinsic value that could be used as money, only scarce but no intrinsic value, I think people would still take up something. (I’m using the word scarce here to only mean limited potential supply)”

___

“A rational market price for something that is expected to increase in value will already reflect the present value of the expected future increases. In your head, you do a probability estimate balancing the odds that it keeps increasing.”

___

“I’m sure that in 20 years there will either be very large transaction volume or no volume.”

___

“Bitcoins have no dividend or potential future dividend, therefore not like a stock. More like a collectible or commodity.”

Promising unusually high or consistent investment returns is a common red flag for being a Ponzi scheme, and with Satoshi’s original Bitcoin, there was none of that.

Over time, Bitcoin investors have often predicted very high prices (and so far those predictions have been correct), but the project itself from inception did not have those attributes.

Open Source: The Opposite of Secrecy

Most Ponzi schemes rely on secrecy. If the investors understood that an investment they owned was actually a Ponzi scheme, they would try to pull their money out immediately. This secrecy prevents the market from appropriately pricing the investment until the secret gets found out.

For example, investors in Bernie Madoff’s scheme thought they owned a variety of assets. In reality, earlier investor outflows were just being paid back from new investor inflows, rather than money being made from actual investments. The investments listed on their statements were fake, and for any of those clients, it would be nearly impossible to verify that they are fake.

Bitcoin, however, works on precisely the opposite set of principles. As a distributed piece of open source software that requires majority consensus to change, every line of code is known, and no central authority can change it. A key tenet of Bitcoin is to verify rather than to trust. Software to run a full node can be freely downloaded and run on a normal PC, and can audit the entire blockchain and the entire money supply. It relies on no website, no critical data center, and no corporate structure.

For this reason, there are no “issues with paperwork” or “difficulty receiving payments”, referencing some of the SEC red flags of a Ponzi. The entire point of Bitcoin is to not rely on any third parties; it is immutable and self-verifiable. Bitcoin can only be moved with the private key associated with a certain address, and if you use your private key to move your bitcoins, there is nobody who can stop you from doing so.

There are of course some bad actors in the surrounding ecosystem. People relying on others to hold their private keys (rather than doing so themselves) have sometimes lost their coins due to bad custodians, but not because the core Bitcoin software failed. Third-party exchanges can be fraudulent or can be hacked. Phishing schemes or other frauds can trick people into revealing their private keys or account information. But these are not associated with Bitcoin itself, and as people use Bitcoin, they must ensure they understand how the system works to avoid falling for scams in the ecosystem.

No Pre-Mine

As previously mentioned, Satoshi mined virtually all of his coins at a time when the software was public and anybody else could mine them. He gave himself no unique advantage in acquiring coins faster or more easily than anyone else, and had to expend computational power and electricity to acquire them, which was critical in the early period for keeping the network up and running. And as previously mentioned, the white paper was released before any of it, which would be unusual or risky to do if the goal was mainly about personal monetary gain.

In contrast to this unusually open and fair way that Bitcoin was launched, many future cryptocurrencies didn’t follow those same principles. Specifically, many later tokens had a bunch of pre-mined conceptions, meaning that the developers would give themselves and their investors coins before the project becomes public.

Ethereum’s developers provided 72 million tokens to themselves and their investors prior to any being available to own by the broader public, which is more than half of the current token supply of Ethereum. It was a crowdsourced project.

Ripple Labs pre-mined 100 billion XRP tokens with the majority being owned by Ripple Labs, and gradually began selling the rest to the public, while still holding the majority, and is currently being accused by the SEC of selling unregistered securities.

Besides those two, countless other smaller tokens were pre-mined and sold to the public.

A case can be made in favor of pre-mining in certain instances, although some are very critical of the practice. In a similar way that a start-up company offers equity to its founders and early investors, a new protocol can offer tokens to its founders and early investors, and crowdsourced financing is a well-accepted practice at this point. I’ll leave that debate to others. Few would dispute that early developers can be compensated for work if their project takes off, and funds are helpful for early development. As long as it’s fully transparent, it comes down to what the market thinks is reasonable.

When defending against the notion of being a Ponzi scheme, however, Bitcoin is miles ahead of most other digital assets. Satoshi showed the world how to do it first with a white paper months in advance, and then put the project out there in an open source way on the first day of spendable coins being generated, with no pre-mine.

A situation where the founder gave himself virtually no mining advantage over other early adaptors, sure is the “cleanest” approach. Satoshi had to mine the first blocks of coins with his computer just like anyone else, and then never spent them other than by sending some of his initial batch out for early testing. This approach improved the odds of it becoming a viral movement, based on economic or philosophical principles, rather than strictly about riches. Unlike many other blockchains over the years, Bitcoin development occurred organically, by a revolving set of large stakeholders and voluntary user donations, rather than via a pre-mined or pre-funded pool of capital.

On the other hand, giving yourself and initial investors most of the initial tokens and then having later investors start from mining from scratch or buy into it, opens up more avenues for criticisms and skepticism and begins to look more like a Ponzi scheme, whether or not it actually is.

Leaderless Growth

One thing that makes Bitcoin really interesting is that it’s the one big digital asset that flourished without centralized leadership. Satoshi created it as its anonymous inventor, worked with others to guide it through the first two years with continued development on open forums, and then disappeared. From there, other developers took the mantle in terms of continuing to develop and promote Bitcoin.

Some developers have been extremely important, but none of them are critical for its ongoing development or operation. In fact, even the second round of developers after Satoshi largely went in other directions. Hal Finney passed away in 2014. Some other super-early Bitcoiners became more interested in Bitcoin Cash or other projects at various stages.

As Bitcoin has developed over time, it has taken on a life of its own. The distributed development community and userbase, (and the market, when it comes to pricing various paths after hard forks) has determined what Bitcoin is, and what it is useful for. The narrative has changed and expanded as time went on, and market forces rewarded or punished various directions.

For years, debates centered around whether Bitcoin should optimize for storing value or optimize for frequent transactions on the base layer, and this is what led to multiple hard forks that all devalued compared to Bitcoin. The market clearly has preferred Bitcoin’s base layer to optimize for being a store of value and large transaction settlement network, to optimize for security and decentralization, with an allowance for frequent smaller transactions to be handled on secondary layers.

Every other blockchain-based token, including hard forks and those associated with totally new blockchain designs, comes on the coattails of Bitcoin, with Bitcoin being the most self-sustaining project of the industry. Most token projects are still founder-led, often with a big pre-mine, with an unclear future should the founder no longer be involved. Some of the sketchiest tokens have paid exchanges for being listed, to try to jump-start a network effect, whereas Bitcoin always had the most natural growth profile.

Unregistered Investments and Unlicensed Sellers

The only items on the red flag list that may apply to Bitcoin are the points that refer to investments that are unregulated. This doesn’t inherently mean that something is a Ponzi; it just means that a red flag is present and investors should be cautious. Especially in the early days of Bitcoin, buying some magical internet money would of course be a highly risky investment for most people to make.

Bitcoin is designed to be permission-less; to operate outside of the established financial system, with philosophical leanings towards libertarian cryptographic culture and sound money. For most of its life, it had a steeper learning curve than traditional investments, since it rests on the intersection of software, economics, and culture.

Some SEC officials have said that Bitcoin and Ethereum are not securities (and by logical extension, have not committed securities fraud). Many other cryptocurrencies or digital assets have, however, been classified as securities and some like Ripple Labs have been charged with selling unregistered securities. The IRS treats Bitcoin and many other digital assets like commodities for tax purposes.

So, in the early days, Bitcoin may have indeed been an unregistered investment, but at this point it has a place in tax law and regulatory frameworks around the world. Regulation changes over time, but the asset has reached the mainstream. It’s so mainstream that Fidelity and other custodians hold it for institutional clients and J.P. Morgan gives their price targets for it.

Many people who have not looked deeply into the industry lump all “cryptocurrencies” together. However, it’s important for prospective investors to look into the details and find important differences. Lumping “cryptocurrencies” together would be like lumping “stocks” together. Bitcoin is clearly not like the others in many attributes, and was launched and sustained in a way that looks more like a movement or a protocol than an investment, but that over time became an investment as well.

From there, folks can choose to look into the rabbit hole of thousands of other tokens that came in Bitcoin’s wake and make their own conclusions. There’s a big spectrum there from well-intentioned projects on one side, to outright scams on the other side. It’s important to realize, however, that even if real innovation is happening somewhere, doesn’t mean the tokens associated with that project will necessarily have durable value. If a token solves some novel problem, its solution could end up being re-adapted to a layer on a larger protocol with a bigger network effect. Likewise, any investment in those other tokens has an opportunity cost of being able to purchase more Bitcoin instead.

Section Summary: Clearly Not a Ponzi Scheme

Bitcoin was launched in the fairest way possible.

Satoshi first showed others how to do it with the white paper in an academic sense, and then did it himself months later, and anyone could begin mining alongside him within the first days as some early adopters did. Satoshi then distributed the development of the software to others and disappeared, rather than continue to promote it as a charismatic leader, and so far has never cashed out.

From the beginning, Bitcoin has remained an open source and fully transparent project, and has the most organic growth trajectory of the industry. Given available information, the market has priced it as it sees fit, out in the open.

The Broader Definition of a Ponzi

Because the narrow Ponzi scheme clearly doesn’t apply to Bitcoin, some folks have used a broader definition of a Ponzi scheme to assert that Bitcoin is one.

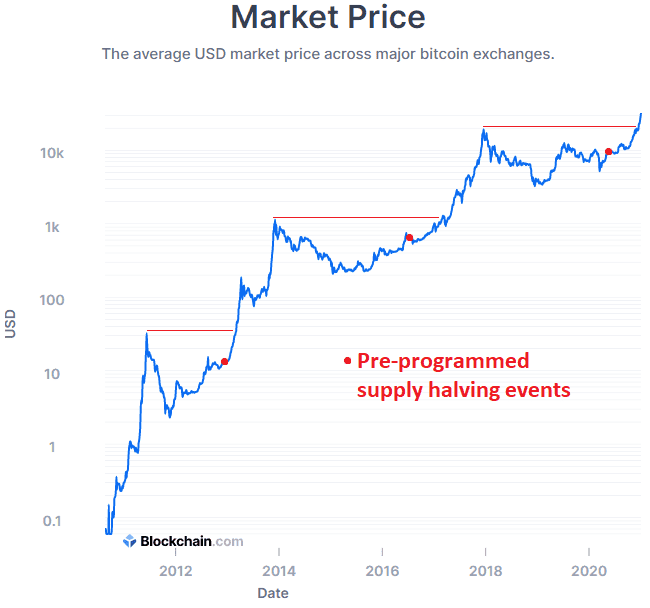

A bitcoin is like a commodity, in the sense that it’s a scarce digital “object” that provides no cash flow, but that does have utility. They are limited to 21 million divisible units, of which over 18.5 million have already mined according to the pre-programmed schedule. Every four years, the number of new bitcoins generated per ten minute block will be cut in half, and the total number of bitcoins in existence will asymptotically move towards 21 million.

Like any commodity, it produces no cash flows or dividends, and is only worth what someone else will pay you for it or trade you for it. And specifically, it is a monetary commodity; one whose utility is entirely about storing and transmitting value. This makes gold its closest comparison.

Bitcoin vs Gold Market

Some people assert that Bitcoin is a Ponzi scheme because it relies on an ever-larger pool of investors coming into the space to buy from earlier investors.

To some extent this reliance on new investors is correct; Bitcoin keeps growing its network effect, reaching more people and bigger pools of money, which keeps increasing its usefulness and value.

Bitcoin will only be successful in the long run if its market capitalization reaches and sustains a very high level, in part because its security (hash rate) is inherently connected to its price. If for some reason demand for it were to permanently flatline and turn down without reaching a high enough level, Bitcoin would remain a niche asset and its value, security, and network effect could deteriorate over time. This could begin a vicious cycle of attracting fewer developers to keep building out its secondary layers and surrounding hardware/software ecosystem, potentially resulting in quality stagnation, price stagnation, and security stagnation.

However, this doesn’t make it a Ponzi scheme, because by similar logic, gold is a 5,000 year old Ponzi scheme. The vast majority of gold’s usage is not for industry; it’s for storing and displaying wealth. It produces no cash flows, and is only worth what someone else will pay for it. If peoples’ jewelry tastes change, and if people no longer view gold as an optimal store of value, its network effect could diminish.

There are 60+ years of gold’s annual production supply estimated to be available in various forms around the world. And that’s more like 500 years worth of industrial-only supply, factoring out jewelry and store-of-value demand. Therefore, gold’s supply/demand balance to support a high price requires the ongoing perception of gold as an attractive way to store and display wealth, which is somewhat subjective. Based on the industrial-only demand, there is a ton of excess supply and prices would be way lower.

However, gold’s monetary network effect has remained robust for such a long period of time because the collection of unique properties it has is what made it continually regarded as being optimal for long-term wealth preservation and jewelry across generations: it’s scarce, pretty, malleable, fungible, divisible, and nearly chemically indestructible. As fiat currencies around the world come and go, and rapidly increase their per-unit number, gold’s supply remains relatively scarce, only growing by about 1.5% per year. According to industry estimates, there is about one ounce of above-ground gold per person in the world.

Similarly, Bitcoin relies on the network effect, meaning a sufficiently large number of people need to view it as a good holding for it to retain its value. But a network effect is not a Ponzi scheme in and of itself. Prospective investors can analyze the metrics of Bitcoin’s network effect, and determine for themselves the risk/reward of buying into it.

Bitcoin vs Fiat Banking System

By the broadest definition of a Ponzi scheme, the entire global banking system is a Ponzi scheme.

Firstly, fiat currency is an artificial commodity, in a certain sense. A dollar, in and of itself, is just an object made out of paper, or represented on a digital bank ledger. Same for the euro, the yen, and other currencies. It pays no cash flows on its own, although institutions that hold it for you might be willing to pay you a yield (or, in some cases, could charge you a negative yield). When we do work or sell something to acquire dollars, we do so only with the belief that its large network effect (including a legal/government network effect) will ensure that we can take these pieces of paper and give them to someone else for something of value.

Secondly, when we organize these pieces of paper and their digital representations in a fractional-reserve banking system, we add another complicated layer. If about 20% of people were to try to pull their money out of their bank at the same time, the banking system would collapse. Or more realistically, the banks would just say “no” to your withdrawal, because they don’t have the cash. This happened to some US banks in early 2020 during the pandemic shutdown, and occurs regularly around the world. That’s actually one of the SEC’s red flags of a Ponzi scheme: difficulty receiving payments.

In the well-known musical chairs game, there is a set of chairs, someone plays music, and kids (of which there is one more than the number of chairs) start walking in circles around the chairs. When the music stops, all of the kids scramble to sit in one of the chairs. One slow or unlucky kid doesn’t get a seat, and therefore leaves the game. In the next round, one chair is removed, and the music resumes for the remaining kids. Eventually after many rounds, there are two kids and one seat, and then there is a winner when that round ends.

The banking system is a permanent round of musical chairs. There are more kids than chairs, so they can’t all get one. If the music were to stop, this would become clear. However, as long as the music keeps going (with occasional bailouts via printed money), it keeps moving along.

Banks collect depositor cash, and use their capital to make loans and buy securities. Only a small fraction of depositor cash is available for withdrawal. A bank’s assets consist of loans owed to them, securities such as Treasuries, and cash reserves. Their liabilities consist of of money owed to depositors, as well as any other liabilities they may have like bonds issued to creditors.

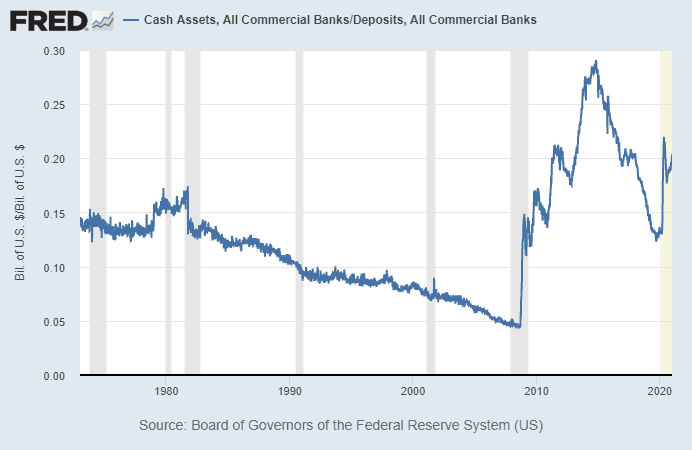

For the United States, banks collectively have about 20% of customer deposits held as cash reserves:

As the chart shows, this percentage reached below 5% prior to the global financial crisis (which is why the crisis was so bad, and marked the turning point in the long-term debt cycle), but with quantitative easing, new regulations, and more self-regulation, banks now have about 20% of deposit balances as reserves.

Similarly, the total amount of physical cash in circulation, which is exclusively printed by the US Treasury Department, is only about 13% as much as the amount of commercial bank deposits, and only a tiny fraction of that is actually held by banks as vault cash. There’s not nearly enough physical cash (by design), for a significant percentage of people to pull their capital out of banks at once. People run into “difficulty receiving payments” if enough of them do so around the same time.

As constructed in the current way, the banking system can never end. If a sufficiently large number of banks were to liquidate, the entire system would cease to function.

If a single bank were to liquidate without being acquired, it would hypothetically have to sell all of its loans and securities to other banks, convert it all to cash, and pay that cash out to depositors. However, if a sufficiently large number of banks were to do that at once, the market value of the assets they are selling would sharply decrease and the market would turn illiquid, because there are not enough available buyers.

Realistically, if enough banks were to liquidate at once, and the market froze up as debt/loan sellers overwhelmed buyers, the Federal Reserve would end up creating new dollars to buy assets to re-liquidity the market, which would radically increase the number of dollars in circulation. Otherwise, everything nominally collapses, because there aren’t enough currency units in the system to support an unwinding of the banking systems’ assets.

So, the monetary system functions as a permanent round of musical chairs on top of artificial government-issued commodities, where there are by far more claims on that money (kids) than money that is currently available to them (chairs) if they were to all scramble for it at once. The number of kids and chairs both keeps growing, but there are always way more kids than chairs. Whenever the system partially breaks, a couple more chairs are added to the round to keep it going.

We accept this as normal, because we assume it will never end. The fractional reserve banking system has functioned around the world for hundreds of years (first gold-backed, and then totally fiat-based), albeit with occasional inflationary events along the way to partially reset things.

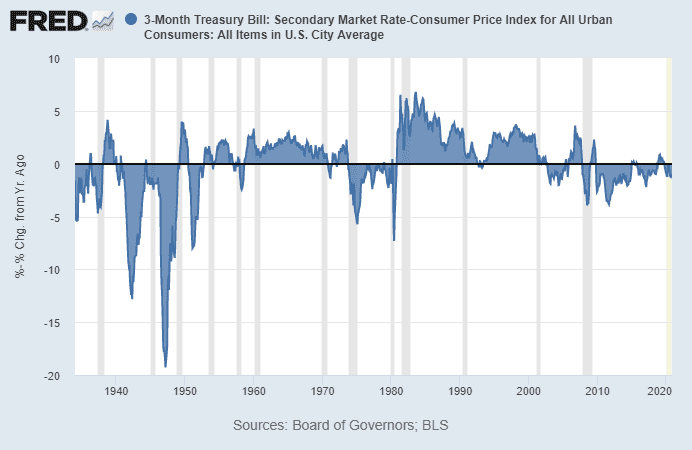

Each individual unit of fiat currency has degraded about 99% in value or more over the multi-decade timeline. This means that investors either need to earn a rate of interest that exceeds the real inflation rate (which is not currently happening), or they need to buy investments instead, which inflates the value of stocks and real estate compared to their cash flows, and pushes up the prices of scarce objects like fine art.

Over the past century, T‑bills and bank cash just kept up with inflation, providing no real return. However, this tends to be very lumpy. There were decades such as the 1940s, 1970s, and 2010s, where holders of T‑bills and bank cash persistently failed to keep up with inflation. This chart shows the T‑bill rate minus the official inflation rate over nine decades:

Bitcoin is an emergent deflationary savings and payments technology that is mostly used in an unlevered way, meaning that most people just buy it, hold it, and occasionally trade it. There are some Bitcoin banks, and some folks that use leverage on exchanges, but overall debt in the system remains low relative to market value, and you can self-custody your own holdings.

Frictional Costs

Another variation of the broader Ponzi scheme claim asserts that because Bitcoin has frictional costs, it’s a Ponzi scheme. The system requires constant work to keep it functioning.

Again, however, Bitcoin is no different in this regard than any other system of commerce. A healthy transaction network inherently has frictional costs.

With Bitcoin, miners invest into customized hardware, electricity, and personnel to support Bitcoin mining, which means verifying transactions and earning bitcoins and transaction fees for doing so. Miners have plenty of risk, and plenty of reward, and they are necessary for the system to function. There are also market makers that supply liquidity between buyers and sellers, or convert fiat currency to Bitcoin, making it easier to buy or sell Bitcoin, and they necessarily extract transaction fees as well. And some institutions provide custody solutions: charging a small fee to hold Bitcoin.

Similarly, gold miners put plenty of money into personnel, exploration, equipment, and energy to extract gold from the ground. From there, various companies purify and mint it into bars and coins, secure and store it for investors, ship it to buyers, verify its purity, make it into jewelry, melt it back down for purification and re-minting, etc. Atoms of gold keep circulating in various forms, due to the work of folks in the gold industry ranging from the finest Swiss minters to the fancy jewelers to the bullion dealers to the “We Buy Gold!” pawn shops. Gold’s energy work is skewed towards creation rather than maintenance, but the industry has these ongoing frictional costs too.

Likewise, the global fiat monetary system has frictional costs as well. Banks and fintech firms extract over $100 billion per year in transaction fees associated with payments, serving as custodians and managers for client assets, and supplying liquidity as market makers between buyers and sellers.

I recently analyzed DBS Group Holdings, for example, which is the largest bank in Singapore. They generate about S$900 million in fees per quarter, or well over S$3 billion per year. Translated into US dollars, that’s over $2.5 billion per year USD in fees.

And that’s one bank with a $50 billion market capitalization. There are two other banks in Singapore of comparable size. J.P. Morgan Chase, the largest bank in the US, is more than 7x as big, and there are several banks in the US that are nearly as large as J.P. Morgan Chase. Just between Visa and Mastercard, they earn about $40 billion in annual revenue. The amount of fees generated by banks and fintech companies around the world per year is over $100 billion.

It requires work to verify transactions and store value, so any monetary system has frictional costs. It only becomes a problem if the transaction fees are too high of a percentage of payment volumes. Bitcoin’s frictional costs are fairly modest compared to the established monetary system, and secondary layers can continue to reduce fees further. For example, the Strike App aims to become arguably the cheapest global payments network, and it runs on the Bitcoin/Lightning network.

This extends to non-monetary commodities as well. Besides gold, wealthy investors store wealth in various items that do not produce cash flow, including fine art, fine wine, classic cars, and ultra-high-end beachfront property that they can’t realistically rent out. There are certain stretches of beaches in Florida or California, for example, with nothing but $30 million homes that are mostly vacant at any given time. I like to go to those beaches because they are usually empty.

These scarce items tend to appreciate in value over time, which is the key reason why people hold them. However, they have frictional costs when you buy them, sell them, and maintain them. As long as those frictional costs are lower than the average appreciation rate over time, they are decent investments compared to holding fiat, rather than being Ponzi schemes.

Section Summary: A Network Effect, Not a Ponzi

The broadest definition of a Ponzi scheme refers to any system that must continually keep operating to remain functional, or that has frictional costs.

Bitcoin doesn’t really meet this broader definition of a Ponzi scheme any more than the gold market, the global fiat banking system, or less liquid markets like fine art, fine wine, collectable cars, or beachfront property. In other words, if your definition of something is so broad that it includes every non-cashflow store of value, you need a better definition.

All of these scarce items have some sort of utility in addition to their store-of-value properties. Gold and art let you enjoy and display visual beauty. Wine lets you enjoy and display gustatory beauty. Collectable cars and beachfront homes let you enjoy and display visual and tactile beauty. Bitcoin lets you make domestic and international settlement payments with no direct mechanism to be blocked by any third party, giving the user unrivaled financial mobility.

Those scarce objects hold their value or increase over time, and investors are fine with paying small frictional costs as a percentage of their investment, as an alternative to holding fiat cash that degrades in value over time.

Yes, Bitcoin requires ongoing operation and must reach a significant market capitalization for the network to become sustainable, but I think that’s best viewed as technological disruption, and investors should price it based on their view of the probability of it succeeding or failing. It’s a network effect that competes with existing network effects; especially the global banking system. And ironically, the global banking system displays more Ponzi characteristics than the others on this list.

Final Thoughts

Any new technology comes with a time period of assessment, and either rejection or acceptance. The market can be irrational at first, either to the upside or downside, but over the fullness of time, assets are weighed and measured.

Bitcoin’s price has grown rapidly with each four-year supply halving cycle, as its network effect continues to compound while its supply remains limited.

Every investment has risks, and it of course remains to be seen what Bitcoin’s ultimate fate will be.

If the market continues to recognize it as a useful savings and payment settlement technology, available to most people in the world and backed up by decentralized consensus around an immutable public ledger, it can continue to take market share as a store of wealth and settlement network until it reaches some mature market capitalization of widespread adoption and lower volatility.

Detractors, on the other hand, often assert that Bitcoin has no intrinsic value and that one day everyone will realize for what it is, and it’ll go to zero. Rather than using this argument, however, the more sophisticated bear argument should be that Bitcoin will fail in its goal to take persistent market share from the global banking system for one reason or another, and to cite the reasons why they hold that view.

The year 2020 was a story about institutional acceptance, where Bitcoin seemingly transcended the boundary between retail investment and institutional allocations. MicroStrategy and Square become the first publicly-traded companies on major stock exchanges to allocate some or all of their reserves to Bitcoin instead of cash. MassMutual became the first large insurance company to put a fraction of its assets into Bitcoin. Paul Tudor Jones, Stanley Druckenmiller, Bill Miller, and other well-known investors expressed bullish views on it. Some institutions like Fidelity were onboard the Bitcoin train for years with an eye towards institutional custodian services, but 2020 saw a bunch more jump on, including the largest asset manager in the world, BlackRock, showing strong interest.

For utility, Bitcoin allows self-custody, mobility of funds, and permission-less settlements. Although there are other interesting blockchain projects, no other cryptocurrency offers a similar degree of security to prevent attacks against its ledger (both in terms of hash rate and node distribution), or has a wide enough network effect to have a high probability of continually being recognized by the market as a store of value in a persistent way.

And importantly, Bitcoin’s growth was the most organic of the industry, coming first and spreading quickly without centralized leadership and promotion, which is what made it more of a foundational protocol rather than a financial security or business project.